Texas A&M University launches entrepreneurial program for petroleum industry

March 9, 2016

|

Mays Business School

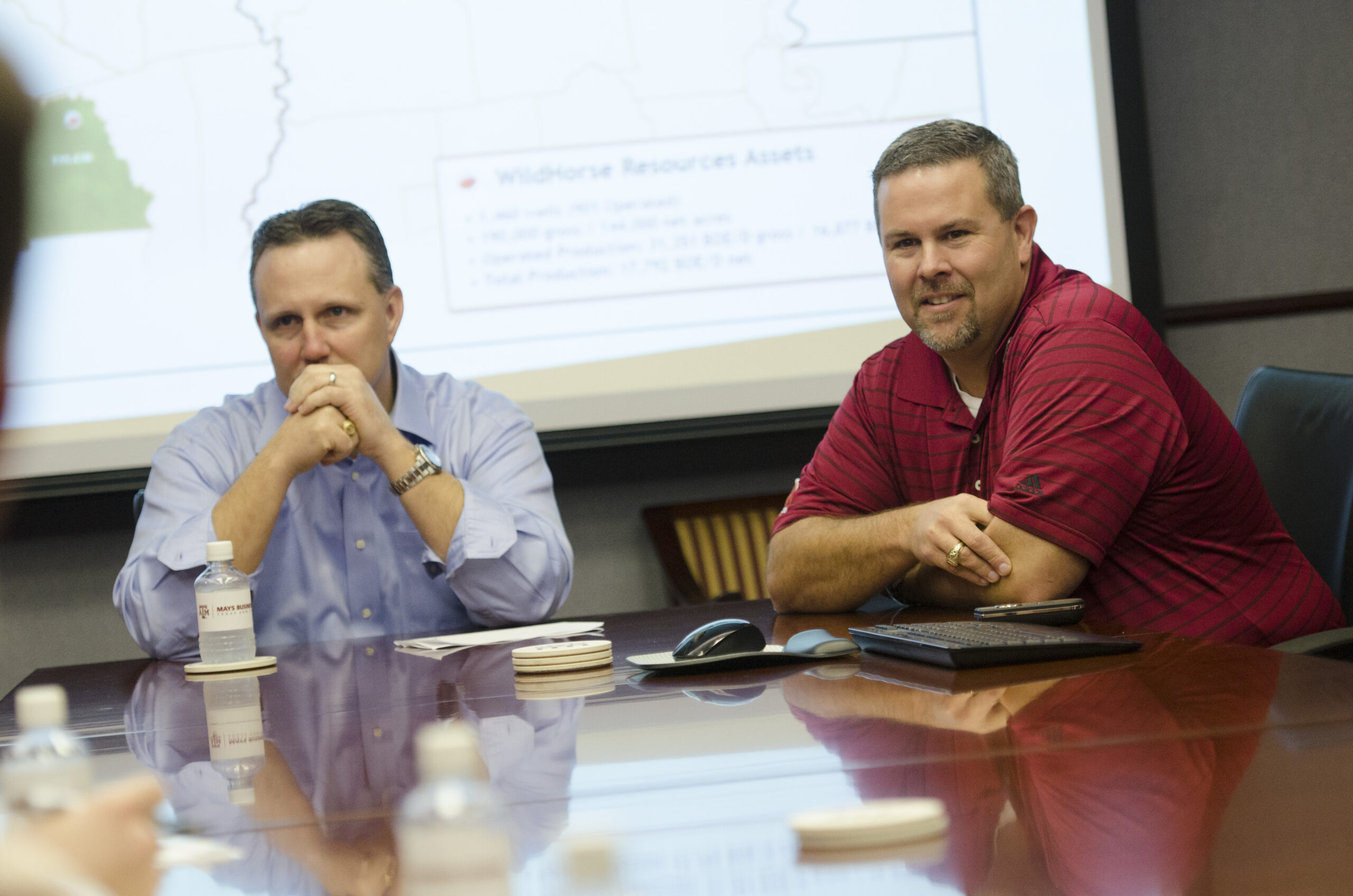

Anthony Bahr ’91 (left) and Jay Graham ’92 funded the Petroleum Ventures Program.

The business and engineering colleges at Texas A&M University are partnering in a new entrepreneurial training program to better prepare undergraduate and graduate students interested in the oil and gas industry.

The Petroleum Ventures Program (PVP) is a certificate program funded by a $12 million gift by Anthony Bahr ’91 and Jay Graham ’92, business partners in Houston-based WildHorse Resources Management Company. Both Bahr and Graham graduated from Texas A&M with petroleum engineering degrees: Bahr in 1991 and Graham in 1992. The partners’ gift stemmed from Bahr and Graham’s personal experience in identifying the industry importance and student benefit of providing business experience to engineering students, as well as the market value of graduating finance students with a specialization in the oil and gas industry.

“Thanks to the generosity and foresight of Mr. Bahr and Mr. Graham, Texas A&M has a magnificent opportunity to have an even more prominent role in providing intellectually transformative learning experiences that are so vital to our state and nation,” said Texas A&M University President Michael Young. “The entrepreneurial emphasis for the program reflects their expectation of excellence and their success – success to which they attribute in part to what they learned here at Texas A&M. It is very fitting that this bold new venture takes advantage of the strengths of both our engineering and business programs, offering an interdisciplinary experience that will well serve our students, presenting them with a competitive advantage among their peers as they enter the workforce.”

This academic collaboration between Mays Business School and the Harold Vance Department of Petroleum Engineering will foster teamwork among petroleum engineering students and students in the Department of Finance at Mays. Students will take courses and work together on projects, and a Petroleum Business Impact Lab will be established.

The first classes for the PVP Certificate Program will be offered in Fall 2016.

The program will target undergraduate and graduate petroleum engineering students and business students who have a desire to work in energy finance or petroleum acquisitions and divestitures fields, as well as petroleum engineers or business graduates who are employed and seeking specialized training. After completing the program, graduates will be better prepared to pursue entrepreneurship opportunities in the petroleum industry.

“Providing entrepreneurial opportunities for our students is critical in better preparing them for our changing workforce requirements,” said M. Katherine Banks, vice chancellor and dean of engineering. “We appreciate Anthony Bahr and Jay Graham for supporting a program that will help increase the marketability and success of graduates.”

The petroleum engineering component will be called the Graham Petroleum Ventures Program and the Mays component will be called the Bahr Petroleum Ventures Program.

“This program is an example of innovation in action, and Mays Business School is honored to step up to serve our state and nation in this very important area,” said Eli Jones, dean of Mays Business School. “We will be connecting the curriculum with industry needs, and giving students a competitive advantage in an interdisciplinary way.”

Graham said the program is a way to bring more formal training in business concepts to petroleum engineers while they are students. He and Bahr credit their success to their mentor and initial investor, Professor Billy P. “Pete” Huddleston. “His influence is interwoven into all of it,” Bahr said. “A lot of the driving force behind why we’re doing this program is to continue and build upon the spark he put into a lot of his students within the petroleum engineering department and push that forward a little bit further.”

Q&A with Detlef R. Hallermann, Clinical Associate Professor and Director of Reliant Trading Center and TRIP

- Why did the university see a need for this program, specifically during the downturn in the oil and gas industry?

No matter whether the industry is in an up-cycle or a down-cycle, there is always a need for petroleum engineers that understand sound financial practices. In a down-cycle, firms are selling their assets and need engineers that can properly value their assets for divestiture. Conversely, the firms buying these assets also need financially adept engineers.

Many Petroleum Engineering alumni have been interested in increasing the students’ exposure to finance in their curriculum for quite some time. The current Petroleum Engineer needs to be more adept at determining the financial feasibility of projects than engineers of previous decades. It is only through the gifts of Jay Graham and Anthony Bahr and a university focus to increase inter-disciplinary activities that we are able to now facilitate crossover between departments at the undergraduate level. Now, engineering students will be able to increase their financial knowledge. In addition, students in finance will be able to increase their knowledge of petroleum engineering.

- With the business and engineering colleges both being involved in the creation of this program, how will they align to address the needs of the industry?

Cathy Sliva of Texas A&M’s Petroleum Engineering Department and Detlef Hallermann of the Finance Department at Texas A&M’s Mays Business School will work together to create the direction and integration for the program. We are fortunate that Cathy has a tremendous background in energy acquisitions, and Detlef started his career as a petroleum engineer. Both have integrated the merger of petroleum engineering and finance into their careers. Both have a strong understanding of the need for a hybrid finance/engineering curriculum and are looking forward to developing this for business and engineering students alike.

- How can an engineering graduate with entrepreneurial training serve as an answer to the difficulty in finding jobs during the downturn?

The keys to succeeding in a difficult environment are to be adaptable and to be very good at what you do. Providing engineering and finance majors the opportunity to develop a hybrid knowledge of petroleum and finance gives both students the opportunity to expand their universe of potential employers. During a down-cycle in the commodity environment, an engineer’s exposure to finance provides them with the skills to enter into banking, mergers and acquisition and trading activities with specific knowledge of the energy sector. These students are of particular interest to firms investing in the energy sector during the down-cycles. Conversely, a finance student with a strong understanding of petroleum engineering principles is extremely valuable to an exploration and production during the up-cycles in the energy sector. Not only do these students have an advantage entering into trading and mergers and acquisition activities, they can also fill in as a financially oriented engineer when demand for human capital once again increases in the energy sector.

- Can you tell me more about the program’s curriculum and topics of study?

The curriculum requires both engineering students and finance students to remain on campus one additional semester. The coursework can be broken into three components:

Foundation courses – Petroleum engineering students take a Foundations of Finance course online (FINC 301). Finance majors are required to take an online Foundations of Petroleum Engineering course (PETE 201). Both of these courses will be taught this summer online.

Core Courses – Petroleum Engineering and Finance students are required to take core courses in their curriculum. As part of the Petroleum Ventures Program, students will be required to take two core classes from the other curriculum.

Petroleum Engineering students will take FINC 351 (Investments) and FINC 361 (Corporate Finance). Finance students will take PETE 353 (Petroleum Valuation) and PETE 489 (Decline Curve Analysis).

Electives – Students will be required to take three electives (one will count towards their technical elective for their major) related to finance (for petroleum engineering majors) or engineering (for finance majors).

In summary, students will perform five additional classes in the partner department. The curriculum should be spread out over three (or more) semesters and should expect to attend Texas A&M University one additional semester to complete their education with the certificate coursework. Students can start their sophomore year.

- Has the program already been launched?

The program will launch in fall 2016 with approximately 25-50 students.

ABOUT MAYS BUSINESS SCHOOL

Texas A&M University’s Mays Business School educates more than 6,000 undergraduate, master’s and doctoral students in accounting, business, finance, management, management information systems, marketing and supply chain management. Mays consistently ranks among the top public business schools in the country for its undergraduate and MBA programs, and for faculty research. The mission of Mays Business School is creating knowledge and developing ethical leaders for a global society.

ABOUT THE COLLEGE OF ENGINEERING

The College of Engineering is the largest college on the Texas A&M campus and one of the largest engineering schools in the country with more than 550 faculty members and more than 15,000 students in 14 departments. The college is ranked seventh in engineering graduate programs and eight in undergraduate engineering programs among public institutions by U.S. News & World Report.